By CA Surekha Ahuja

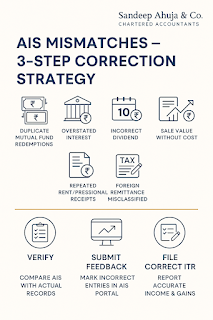

As the deadline for filing Income Tax Returns (ITRs) for Assessment Year 2025–26 approaches, many taxpayers are facing discrepancies in the Annual Information Statement (AIS). A common concern is that certain incomes—especially mutual fund redemptions, interest, and dividends—appear duplicated or inflated, leading to confusion over the correct income and tax liability.

This article outlines the reasons behind such mismatches, the steps taxpayers should take, and how to ensure accurate and compliant return filing, even when AIS data appears inconsistent.

Understanding AIS and Its Limitations

The AIS is a comprehensive statement issued by the Income Tax Department that reflects the financial transactions of a taxpayer for a particular financial year. It includes:

-

TDS and TCS information

-

Interest and dividend income

-

Purchase and sale of securities and mutual funds

-

Foreign remittances

-

Specified Financial Transactions (SFTs)

While the AIS is a valuable reference document, it is based on information reported by third parties—banks, mutual fund companies, registrars, employers, tenants, etc.—and may occasionally contain duplicate or incorrect entries.

Common AIS Discrepancies Observed

Taxpayers frequently encounter the following inconsistencies in their AIS:

1. Duplicate Mutual Fund Redemptions

Often reported by both the Asset Management Company (AMC) and the Registrar and Transfer Agent (RTA), leading to duplication of redemption value and overstated capital gains.

2. Overstated Bank Interest

Some banks report gross interest across all branches or accounts, sometimes including interest accrued but not yet paid, resulting in inflated income figures.

3. Incorrect Dividend Entries

Dividend amounts may be reported even before the record date or for shares not held by the taxpayer, causing a mismatch with actual receipts.

4. Rent or Professional Receipts Repeated

In some cases, the same payer files multiple TDS returns—monthly and annually—resulting in the same income being reflected more than once.

5. Gross Sale Proceeds without Cost

Capital gains may be shown in AIS at gross sale value without adjusting for the cost of acquisition, especially in the TIS (Taxpayer Information Summary), leading to misleading income representations.

6. Foreign Remittances Misclassified

Amounts such as gifts, loans, or repatriations from family members abroad may appear as income due to incorrect classification.

Recommended Course of Action

Taxpayers encountering discrepancies in AIS should take the following structured approach:

Step 1: Cross-Verify with Personal Records

Compare AIS entries with the following:

-

Bank interest certificates

-

Capital gain statements from AMCs or brokers

-

Demat and mutual fund statements

-

Rent agreements or Form 16C

-

TDS certificates (Form 16A)

-

Form 26AS

Identify all cases where AIS entries do not match the actual income earned or the year to which it pertains.

Step 2: Submit Feedback on the AIS Portal

Log into the Compliance Portal of the Income Tax Department and provide appropriate feedback for each incorrect entry. The portal allows taxpayers to specify the reason for mismatch, such as:

-

Duplicate entry

-

Information does not pertain to the taxpayer

-

Amount is incorrect

-

Income not taxable

-

Entry reported under incorrect financial year

This feedback helps the department take note of genuine mismatches and protects the taxpayer in case of future scrutiny.

Step 3: File the ITR Based on Actual Income

It is important to understand that AIS is not a tax computation tool, but a reference document. Taxpayers are expected to file returns based on accurate and substantiated information, even if it differs from the AIS.

For example:

-

Report actual capital gains in Schedule CG after adjusting for cost

-

Include only actual interest earned during the financial year

-

Reconcile TDS claimed with Form 26AS

There is no requirement to wait for AIS to be revised before filing the return. Filing based on verified records, with proper documentation and feedback submission, is fully compliant.

Legal Position and CBDT Clarification

The Income Tax Department has clarified through its FAQs that AIS is for information purposes only and mismatches may be explained by the taxpayer. The filing of the return should be done on the basis of actual transactions and proper documentation.

Thus, taxpayers need not panic or delay return filing due to AIS discrepancies, provided they maintain proper records and have submitted feedback.

Summary of Key Action Points

| Issue Type | Cause | Corrective Action |

|---|---|---|

| Duplicate mutual fund redemption | Reported by both AMC and RTA | Mark duplicate in AIS and report actual gains in return |

| Overstated interest | Aggregated across accounts or branches | Mark incorrect amount in AIS and use actual interest certificate |

| Incorrect dividend | Shares not held on record date | Flag as “Not taxpayer’s income” in AIS |

| Repeated rent/professional income | TDS reported monthly and annually | Use agreement/receipts and adjust in ITR |

| Sale value without cost | Reported gross in AIS | Calculate capital gains as per records and file accordingly |

| Foreign gift shown as income | Misreported by bank or AD | Mark as non-taxable in AIS feedback |

Conclusion

AIS mismatches are increasingly common due to the scale and automation of financial reporting systems. However, taxpayers are not bound to adopt AIS figures blindly. By cross-verifying entries, submitting feedback, and filing accurate returns based on actual income and documentary support, taxpayers can maintain full compliance without fear of mismatch-based scrutiny.

For complex AIS reconciliation or capital gains computation, professional guidance is advisable.